Consistent Results are Worth Billions, Part 2

Read part 1: Fraud Doesn’t Pay, But Consistent Results are Worth Billions

One day you will want to have some outsider set a value for your business as part of an exit strategy or for the purpose of passing the business to a new generation. What management metrics will you use to guide your efforts during the many years leading up to that valuation day? How can you deliver steady, market-beating results that are not affected by the various dips and swings that you inevitably experience while serving your customers? The key is to find a strategy that minimizes volatility and maximizes consistency over a long period. You need to deliver for real what Bernie Madoff falsely projected in order to impress the investors that will ultimately value your business.

Revenue and gross margin are not perfect measurements for management success, so what are the measurements that matter? How can the owners of the business look back at the past month or quarter and make a judgment regarding success or failure? If the business is an investment, it should be measured like an investment, and the investments that people value most highly are those that deliver predictable returns over and over again. Bernie Madoff famously played on this investor bias by cooking the books to show steady and consistent returns, no matter what the market conditions, in order to lure more investors to his Ponzi scheme. Investors will always pay a premium for an investment with steady and consistent returns. So what are you going to measure to be certain you are optimizing for consistent and predictable returns?

Your service contracting business, just like an investment firm, faces uncertain market conditions. Instead of swings in the Dow Jones Industrial Average, the S&P 500, and the NASDAQ, you are dealing with cold weather, hot weather, fuel price fluctuations, tight labor markets, and swings in customer buying sentiment brought about by the same economic indicators that affect Wall Street. In the face of all of these potential distractions, you need a simple and effective formula to focus your team on the long-term measurements that matter so that they can more effectively navigate a path through the potential chaos. I have a simple, easy to remember measuring stick to help you focus your management team on the outcomes that maximize shareholder value, but before I reveal it, see how you do in answering these questions:

- How many customers do you have under an annual or longer maintenance contract?

- What is the monthly recurring revenue (MRR) or annual recurring revenue (ARR) for these contract customers? This is the predictable maintenance, monitoring, and inspection revenue that always shows up on the income statement regardless of market conditions.

- What is the total contract value (TCV) of future committed revenue for maintenance, monitoring, and inspections for all customers under contract? Are your customers signing two-, three-, and four-year commitments to you?

- How many customers pay you in advance for your maintenance program? What is the amount of deferred revenue on the balance sheet? A higher amount of deferred revenue means that customers are paying you in advance for your services. Paying in advance means they are more committed to your services and your contract. It also means you can use that cash to fund sales to new customers.

- What is the ratio of planned service revenue (maintenance, inspections, quoted repairs) to unplanned service revenue (emergency service calls where something broke)? Higher ratios mean better customer service, and better customer service means customers will stick with your company for a longer term. Customers do not like unplanned expenses nor the disruptions they represent.

- What is the net revenue churn in the customer base? How much revenue did you earn this year from customers that have been with you for over a year relative to the revenue from those same customers for the prior year? Ideally, this ratio is 90% or even higher. Minimal account churn means your digital wrap is sticky.

- What is your contract renewal rate? What percentage of customers do not renew their maintenance plan when it comes due? How much annual contract revenue on average do these non-renewing customers represent? These numbers represent your gross churn, and ideally, gross churn should be less than 10%.

All of these questions are directly correlated with the value of a service contracting business (or any subscription or maintenance oriented business for that matter), and not one of them deals directly with the question of gross margin for service calls. Service call gross margin is important, but gross margin on contract maintenance, monitoring, inspections, and planned repairs is actually much more important. Predictable growth is even more important. No investor will complain about an occasional expense hiccup for unplanned services in the context of a highly predictable, growing stream of high margin, contract service fees. The very nature of unplanned repair work (it is unplanned!) makes it volatile and not particularly valuable to an investor, so optimizing gross margin on this work is the least of your concerns. Try to eliminate these disruptive emergency service calls altogether if you can.

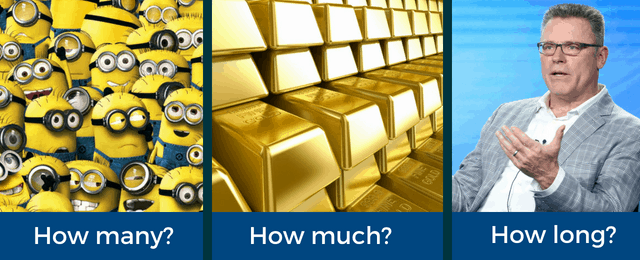

I recognize that many of the questions above are kind of technical and difficult to absorb until you get into the swing of these measurements. It comes down to three simple questions to ask over and over again:

How Many? How Much? How Long?

How many customers you have? How much you earn from them? And how long you keep them?

These three questions that we’ve been talking about underpin the basic value-building fundamentals for almost any business. Read more about How Many? How Much? How Long? value calculations here.